The HPI shows the price changes of residential properties purchased by households (flats, detached houses, terraced houses, etc.), both newly built and existing, independent of their final use and of their previous owners.

After a sharp decline between Q2 2011 and Q1 2013, house prices in the EU remained more or less stable between 2013 and 2014. A rapid rise followed in early 2015, and house prices increased faster than rents until Q3 2022. Since Q4 2022, house prices have fallen for 2 quarters in a row (-1.4% and -0.8%) before rising again in Q2 and Q3 2023 (+0.4% and +0.6%). A slight decrease occurred in Q4 2023 (-0.2%) followed by successive increases from Q1 2024 to Q3 2025 (+0.6%, +1.9%, +1.6%, +0.7, +1.4%, +1.6% and +1.6%, respectively).

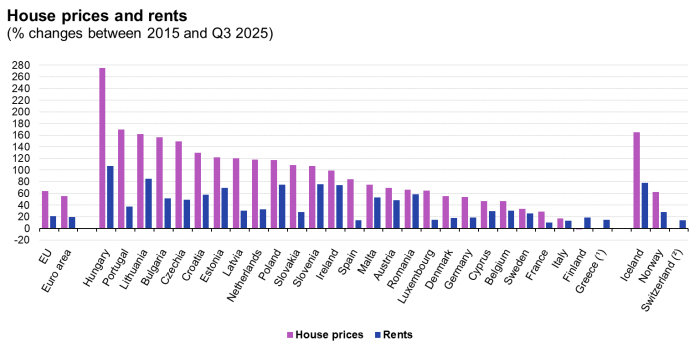

In addition to developments in residential property prices, rental market dynamics warrant close monitoring from a macro-financial and housing affordability perspective. Long-run evidence suggests that house prices and rents followed broadly similar trajectories until 2011; thereafter, a structural divergence emerged. Rental prices have increased at a relatively stable pace, while house prices have displayed substantially higher volatility. Between 2015 and the third quarter of 2025, rents in the EU rose by 21.1%, compared with a cumulative increase of 63.6% in residential property prices.

At the country level, house price growth exceeded rental inflation in nearly all EU Member States. Hungary stands out, with residential property prices more than tripling over the past decade, while pronounced increases were also observed in Portugal, Lithuania, and Bulgaria. Rental prices, by contrast, rose across all Member States, with the strongest increases recorded in Central and Eastern Europe.

Greece broadly aligns with this European pattern, while exhibiting several country-specific characteristics. Following a prolonged and deep contraction during the sovereign debt crisis, the Greek housing market has entered a phase of robust recovery. Unlike economies where residential property prices had already returned to elevated levels prior to 2020, Greece commenced this recovery from a significantly depressed base. This low starting point partly explains the pronounced cumulative price growth observed over the past decade.

The recovery in the Greek housing market reflects a combination of cyclical and structural factors. On the demand side, increased foreign interest, the expansion of tourism-related activity and short-term rentals, and improving macroeconomic fundamentals have supported price dynamics. On the supply side, constraints stemming from limited new residential construction—particularly in metropolitan areas and high-demand tourist regions—have contributed to persistent upward pressures on both prices and rents.

According to the latest estimates published by the Bank of Greece, residential property prices increased by approximately 7.7% on a year-on-year basis in the third quarter of 2025, significantly exceeding the EU average. Over the same period, rental prices rose by around 10.1%, compared with an EU average of 3.1%, indicating comparatively strong rental inflation.

These developments suggest that the Greek housing market is currently characterized by stronger price momentum than the EU average, across both owner-occupied and rental segments. This is also reflected in housing affordability indicators. Greek households devote a markedly higher share of disposable income to housing expenditures than the EU average, with available evidence indicating that housing costs absorb more than one third of disposable income in Greece, compared with approximately 20% at the EU level.

Recent indicators further point to heightened demand for higher-quality residential properties in urban centers. Asking prices in Athens and Thessaloniki have continued to rise at double-digit annual rates, particularly in central and high-demand submarkets. In Athens, indicative asking prices in the city center and southern suburbs range between €2,400 and €4,000 per square meter, with annual growth rates exceeding 10% in certain areas. Comparable trends are observed in Thessaloniki.

Finally, it should be noted that, for Greece, officially published house price indicators are based on valuation data rather than transaction-level prices, which should be taken into account when interpreting recent developments and cross-country comparisons.