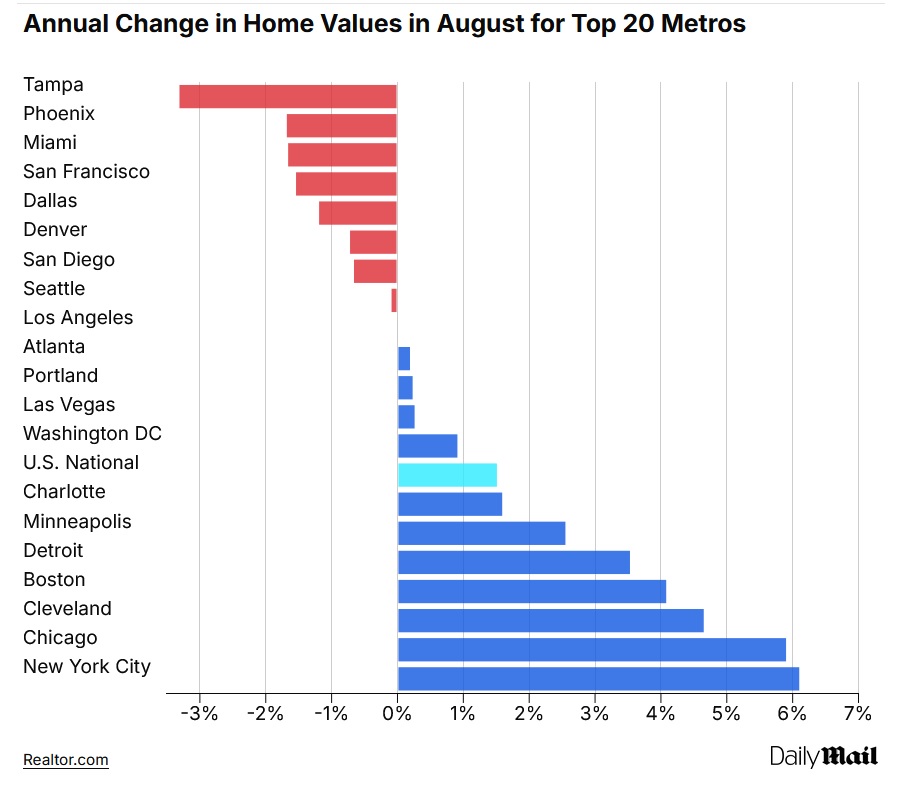

According to market analysts, the latest increase represents a slowdown compared with July’s 1.7% rise, while in many metropolitan areas prices have already begun to decline. Of the 20 cities tracked by the Case-Shiller Index, nine recorded losses and thirteen posted gains below the national average.

Data released this week show that Tampa experienced the sharpest annual price drop at -3.3%, marking ten consecutive months of decline. The city—like many others in Florida—has now officially entered a buyer’s market, a condition in which housing supply exceeds demand, giving buyers greater bargaining power.

Although this development benefits those seeking to purchase homes, it often serves as a warning sign for the broader economy, reflecting weaker purchasing power, elevated interest rates, and declining consumer confidence.

Miami (-1.66%) and Dallas (-1.19%) also posted notable price declines in August and are now considered to be operating under buyer’s market conditions.

The Resilient Regions

The slowdown is most pronounced in the Western states, where demand is declining and prices are stabilizing or falling. Cities such as Phoenix, Denver, San Diego, and Los Angeles have seen significant drops in home values. In contrast, markets in the Northeast and Midwest are performing more strongly. New York recorded the largest price increase, followed by Chicago.

“Markets in these regions remain more stable due to the limited supply of existing homes and sustained demand,” explains Anthony Smith, economist at Realtor.com.

Despite the broader cooling, there is a positive sign: average mortgage rates have fallen to 6.19%, their lowest level in over a year, as the Federal Reserve signals the possibility of future rate cuts. Overall, the U.S. housing market appears to be entering a phase of normalization after the explosive rally during the Covid-19 pandemic years—with prices stabilizing, regional disparities widening, and buyers gaining, at least temporarily, greater leverage.