According to data from RCA (MSCI), processed by Avison Young, investment volumes increased by 16% on a year-on-year basis during the first to third quarters, approaching €1.1 billion.

The outlook is expected to strengthen further in the fourth quarter, as two major transactions involving the sale of real estate portfolios are estimated to propel total investment volumes for the full year above €2 billion. As the company notes, the steady economic recovery, the improvement in the country’s credit rating, and increased investment in energy and infrastructure are among the key factors supporting investor confidence.

Athens and Tourism at the Centre

Investment activity remains strongly concentrated in Athens, which absorbs 67% of total investments, due to the scale of its economic activity and the availability of institutional-grade real estate assets. At the same time, more than one third of investments are directed toward the hospitality sector, both in Athens and in the regions, reflecting the dynamic recovery of tourism. Cross-border investors account for nearly 50% of total activity during the first to third quarters, focusing primarily on hotel properties and enhancing market liquidity and long-term prospects.

The Role of REITs and Private Investors

As stated in Avison Young’s analysis, listed real estate investment companies (REICs – REITs) continue to shape the Greek commercial real estate market, supporting its stability and growth. However, recent trends indicate that many REITs are now operating as net sellers, within the framework of strategic portfolio restructurings. At the same time, private investors are recording a historically high level of participation, representing 46% of total activity. Their interest is focused on assets with stable returns and reliable cash flows.

Greek listed companies remain traditionally overweight in office assets; however, the strong growth of tourism has led to a strategic shift toward hospitality, attracting domestic and international capital. In parallel, the lack of organized and professionally managed residential rental properties strengthens investment interest in the residential sector, although high land and construction costs put pressure on targeted returns.

The logistics sector is gradually gaining a larger share in institutional portfolios, due to strong fundamentals and limited supply, which often leads to pre-let agreements for completed developments. In the retail sector, investment interest is focused on convenience stores and retail schemes with a supermarket as the anchor tenant, which are considered resilient and ensure stable income.

Market Outlook

According to Ms Eri Mitsostergiou, Principal, COO, Capital Markets at Avison Young, “future investment activity is expected to be driven primarily by Greek REITs, which are expanding their allocations to hospitality, residential, and logistics. Major international investors are closely monitoring the market, seeking assets with long-term leases and attractive returns, with a minimum target yield of around 7%. Access to quality assets is achieved mainly through the acquisition of new developments or refurbished properties.”

She also notes that “although more value-add opportunities are expected, the gap between buyer and seller expectations may prolong negotiations or delay certain transactions.”

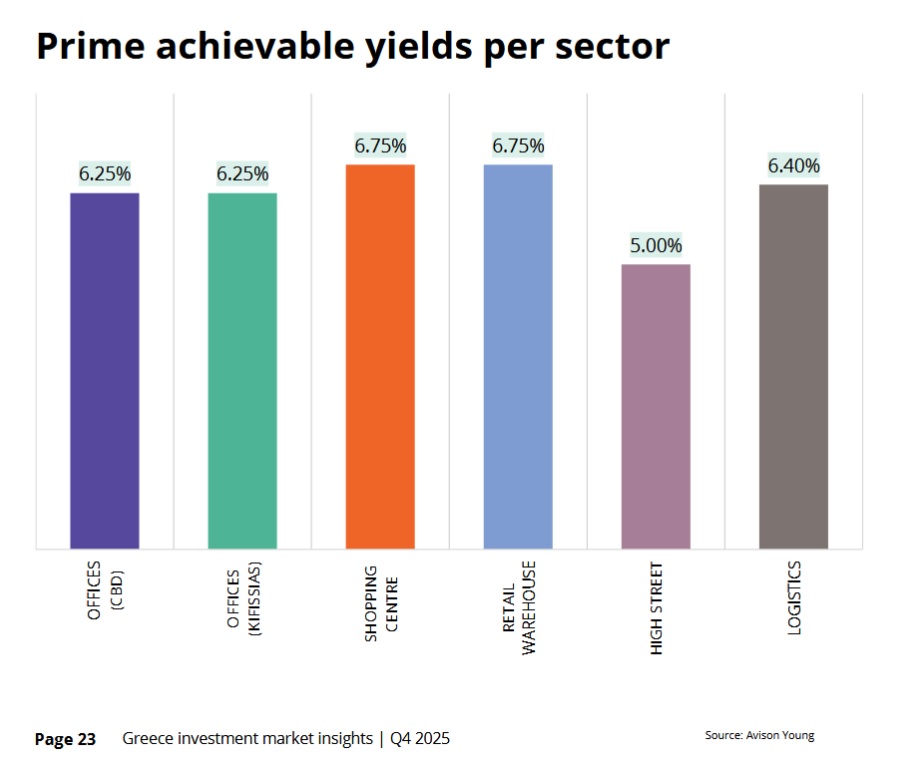

Finally, with regard to yields, prime yields for high-quality assets are expected to remain stable, as prospects for further rental growth are limited. Domestic investors continue to outperform international investors in terms of pricing, while the latter apply a higher risk premium.