Cushman & Wakefield released its 33rd edition of Main Streets Across the World, examining retail rental rates in prime locations in cities around the world.

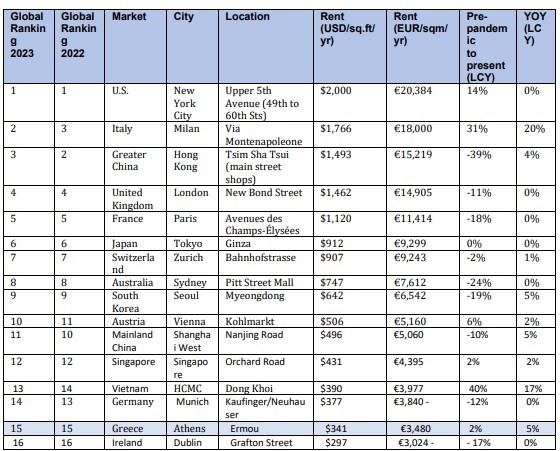

- New York’s Fifth Avenue retains its top ranking as the world’s most expensive retail destination, despite recording flat rental growth yearover-year (YOY).

- Milan’s Via Montenapoleone jumped a spot into second, displacing Hong Kong’s Tsim Sha Tsui, which placed third in 2023.

- New Bond Street in London and the Avenues des Champs-Élysées in Paris retained fourth and fifth positions, respectively.

- The biggest mover was Istiklal Street in Istanbul, up from 31st to 20th position, as rampant inflation caused rents to more than double over the past year.

“The retail sector has continued to face issues head on while demonstrating its resiliency. The near-term outlook for the retail sector remains cautious, but at the same time is nuanced between sub-sectors and geographical locations,” said Barrie Scardina, Head of Americas Retail.

“At the macro level, the focus is on the strength of consumer spending. As central banks have undertaken one of the most aggressive interest rate hiking cycles in decades, consumers have shifted spending patterns and are reigning in non-discretionary expenditure.”

As the world continues to emerge from the impacts of the global pandemic, prime retail destinations similarly have continued their rebound, recording mostly positive rental growth over the past year.

- Rents across global prime retail destinations continued their ongoing recovery, increasing on average 4.8% in local currency terms over the past year. The strongest growth was recorded in Asia Pacific, which averaged 5.9%, with Europe at 4.2% and the Americas at 5.2%.

- Notwithstanding comparatively strong growth over the past year, in most instances, the increase in rents did not match levels of peak inflation.

- Furthermore, almost 60% of markets globally remain below prepandemic rental levels. This is most evident in Europe where 70% of markets are below pre-pandemic rents. In contrast, in the U.S., only 31% are below pre-pandemic levels; 69% are above.

The macroeconomic trends which had become more evident in 2022 have

continued through this year and will likely continue into the next,” said Scardina.

Ermou maintains its ranking for another year

In Ermou, rents did not follow the downward trend of the European markets, with rents fluctuating on an annual basis at the same levels compared to before the pandemic and slightly higher, according to the managing director of Cushman & Wakefield Proprius, Niki Sympoura.

The fact "the durability in rents is mainly the result of the low availability of spaces in Ermou, the competition between merchants to secure a central store in this market, but also the tourist traffic in combination with the improvement of indicators in relation to consumption, expectations, liquidity etc. .etc "Flight to Best" now prevails in all real estate markets".