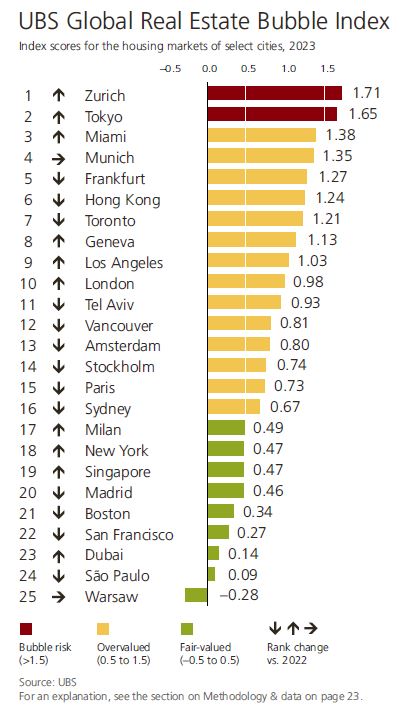

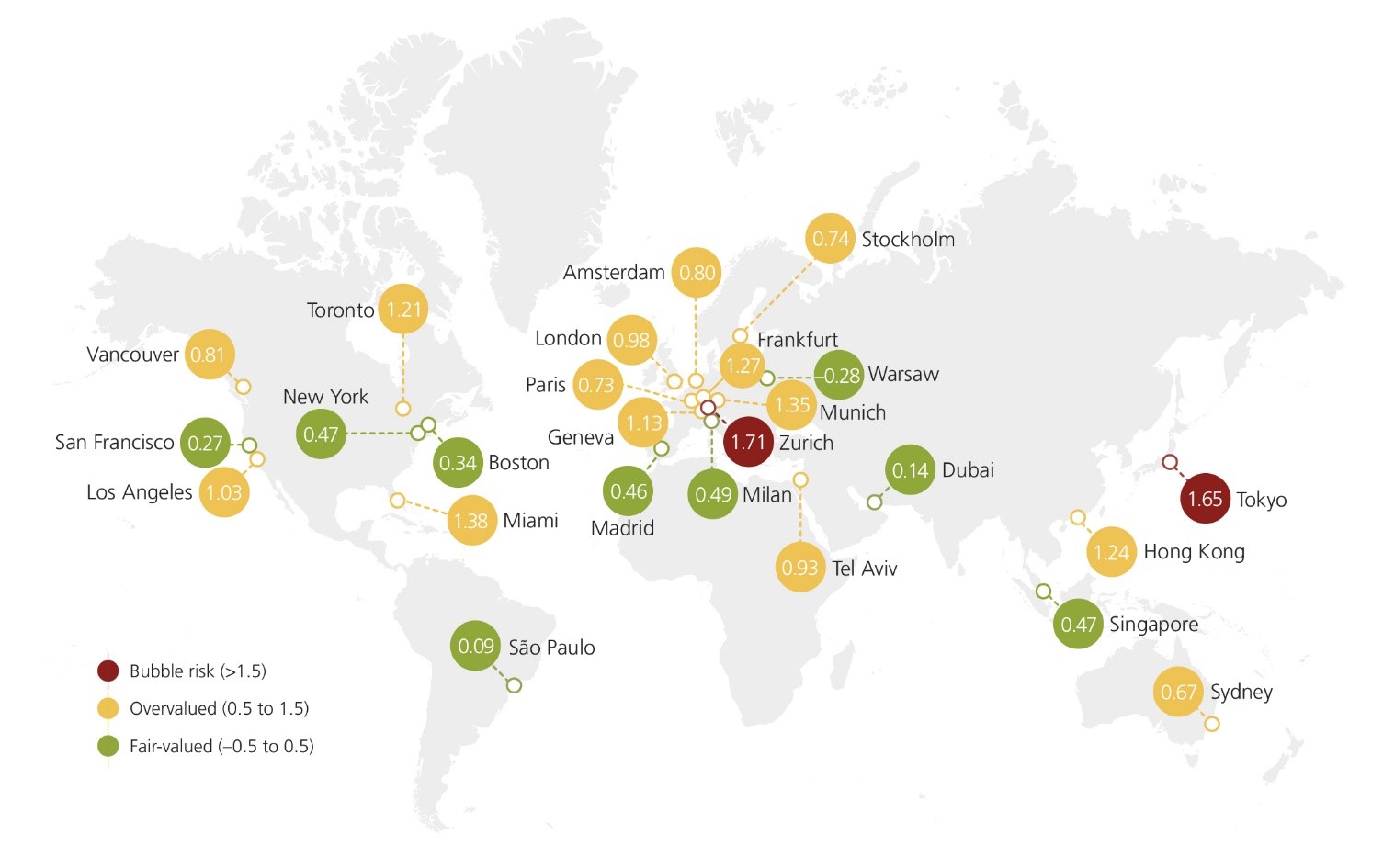

On average of all cities, within the past year, inflation-adjusted home prices have seen the sharpest drop since the global financial crisis in 2008 according to the UBS Global Real Estate Bubble Index.

Cities that have been classified in the bubble risk zone at least once in the past three years recorded an even stronger average price decline. However, the impact of higher interest rates has varied markedly across cities, with the price correction depending on several other factors as well.

Where home financing was already at the limit of affordability with low interest rates, higher interest rates almost inevitably led to a slump in local demand. If a market was characterized by a significant decoupling of purchase prices from rents, the rise in mortgage rates shifted demand back to the rental market.

In housing markets that were predominantly short-term financed, owner households immediately felt the higher financing costs and were forced to accept lower prices when selling. Where buy-to-let became popular during the low interest rate period, fire sales due to higher interest rates and slumping profitability intensified a correction. In cities where several of these factors came together at the same time—as in Toronto, Frankfurt, and Stockholm, for example—re-pricing took place all the faster and more severely.

Price corrections across the board

The house price level in both German cities analyzed, Frankfurt

and Munich, doubled between 2012 and 2022, which was

the strongest growth of all cities included in the study. Solid

economic and employment growth, falling mortgage rates,

strong investment demand, and supply shortages supported

higher prices. But prices have been overshooting, in our view.

Rate hikes and high inflation triggered a revaluation. Peaking

in early 2022, real prices in Frankfurt have corrected by almost

20% since then, and by 15% in

Munich. Both cities have left the bubble risk zone, but remain

highly overvalued. The correction is still ongoing.

Real prices in London’s housing market have been on a downward path since Brexit in 2016. Despite structural supply shortages, prices have lagged the nationwide average. In the absence of strong international demand, house prices remain under pressure as—due to high mortgage rates—local affordability is at its worst since 2007. Additionally, demand for buyto-let investments has abated: Although rents have increased in nominal terms, they could not offset rising financings costs. The market remains in overvalued territory, according to UBS.

Madrid’s housing market is in fair value territory. Compared to other Eurozone cities, the Spanish capital has remained affordable as measured by the price-to-income ratio. After a three-year period of stagnation, prices increased by 3% in inflation-adjusted terms over the last four quarters.

Overall, they remain 25% below the all-time high in 2007. Demand is shifting to the rental market as higher interest rates reduce the attractiveness of purchasing property. More build-to-rent developments are expected, keeping the market in balance. Milan’s housing market has recorded rising prices since 2018. Falling mortgage rates, a robust economy, new developments, and a favorable tax regime supported housing demand.

Though nominal prices continued to rise between mid-2022 and mid-2023, they could not keep up with inflation. Real prices dropped by 2%, in line with local real rental and income growth. The market remains fairly valued, virtually unchanged from last year, according to the UBS Global Real Estate Bubble Index report. Solid prospects for the local economy, an extension of the underground railway, and the upcoming 2026 Olympic Winter Games all contribute to sustaining valuations in nominal terms.