The long period of rising prices in the global residential real estate market during 2022 in many places came to an abrupt halt and in some cases even reversed. The reason, according to Deutsche Bank's analysis "PERSPECTIVES, THE OUTLOOK FOR 2023", is the sharp increase in funding costs as a result of increases in key interest rates by central banks.

Increased financing costs

In the US, for example, mortgage rates have risen since the beginning of the year and from an average of 3.3%, they rose to 7% at the highest level in the last 20 years. In Germany, construction financing costs tripled from around 1% to nearly 4% over the same period. These developments have had a negative impact on the affordability of housing as a real estate asset.

This has resulted in the number of homes sold in the US, for example, being down almost 30% from the peak year of 2020. Monthly forecasts have recently been reduced with the country's housing and apartment supply index showing a downward trend over the past ten months.

On the other hand, there is a persistently high demand for living space, which will increase in the coming years while on the other hand vacancy rates in the US and Germany are still at the same historically low levels. In Germany the number/target of 400,000 apartment completions per year seems to be too far. According to Deutsche Bank estimates, just 280,000 apartments would have been completed by the end of 2022 and only 250,000 in 2023.

Soaring construction costs

In addition to increased financing costs, the large increase in construction costs is likely to put the brakes on potential new construction projects. For example, particle board and structural steel prices have increased by 70% within 2022 compared to the previous year. In addition, there are strict building regulations, a lack of design and construction capabilities, and rising labor costs due to a growing shortage of labor and skilled workers.

At the same time that something not only needs to be built immediately, but also built in an energy-efficient way, one can hardly expect the prices of newly built residential properties to fall in the near future.

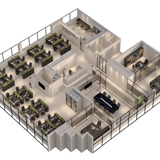

Commercial real estate and logistics

The commercial real estate sector and logistics in particular could offer interesting prospects and possibilities according to Deutsche Bank. Growing online commerce, as well as increasing demand for warehouse space to offset supply chain issues, are keeping vacancy rates near historic lows. In this context, rent increases seem easier to prevail.

Vacancy rates for commercial properties and offices are rising

Vacancy rates for commercial and office properties are significantly higher. This is likely due to the increasing trend towards online shopping and working from home. For now, Deutsche Bank expects that this trend will possibly last another one to two years.

In any case, this asset class is attractive. Especially when rents are likely to continue to rise over the long term, particularly in metropolitan areas where inflation-linked rents are becoming more common. Investments in a well-diversified portfolio are one good solution.