The 2022 Global Real Estate Transparency Index (GRETI) reveals a widening transparency gap as the leading countries pull further ahead and set higher standards, from new regulations covering energy efficiency and emissions standards for buildings and climate risk reporting; to raising the bar for Anti-Money Laundering (AML) and beneficial ownership reporting; to providing deeper data on everything from office utilization rates to niche property types, supported by the rapid uptake of technology.

Progress lower down the global rankings has been slow as many

jurisdictions plateau or even regress and they will need to move faster to meet

heightened expectations.

Pressure has continued to grow for the real estate industry to meet the challenge of decarbonization. Sustainability – and the race to net zero emissions – has become the new marker of transparency as investors, companies, governments and the public look for clear long-term targets, regulatory standards and metrics to measure their environmental impact and risk.

Sustainability has been the biggest driver of transparency improvements across markets in GRETI 2022, with increasing numbers of countries and cities setting mandatory energy efficiency and emissions standards for buildings and the more widespread adoption of green and healthy building certifications.

The leading markets are now also beginning to mandate sustainability reporting from companies and are collecting public building-level information on energy efficiency and emissions.

The drive to improve productivity and uncover new revenue streams in the industry – as well as to respond to changes in how we live and work after the COVID pandemic – has spurred a rapid increase in the use of real estate technology platforms. The availability of new, high-frequency data and more granular data is boosting the transparency of real estate in ways that were unimaginable just a decade ago.

In some countries, the result is a more in-depth understanding of buildings and markets than ever before, from realtime occupancy or foot-traffic tracking to data aggregators compiling information on developing asset types, and even the use of building and city-level digital twins for urban planning and forecasting.

Diversification is a core theme for many investors, and with institutional capital active in ‘alternative’ sectors in nearly two-thirds of markets tracked, expectations for higher transparency across niche property types like lab space, data centers and student housing have grown.

Transparency and information on operating and

pricing fundamentals in many of these niche parts of the market is rising but remains

considerably lower than in established property types, with over one-third of markets

lacking any reliable data outside the ‘core’ sectors.

The Global Real Estate Transparency Index (GRETI), produced jointly by JLL and LaSalle Investment Management, has been charting the evolution of real estate transparency across the globe since 1999.

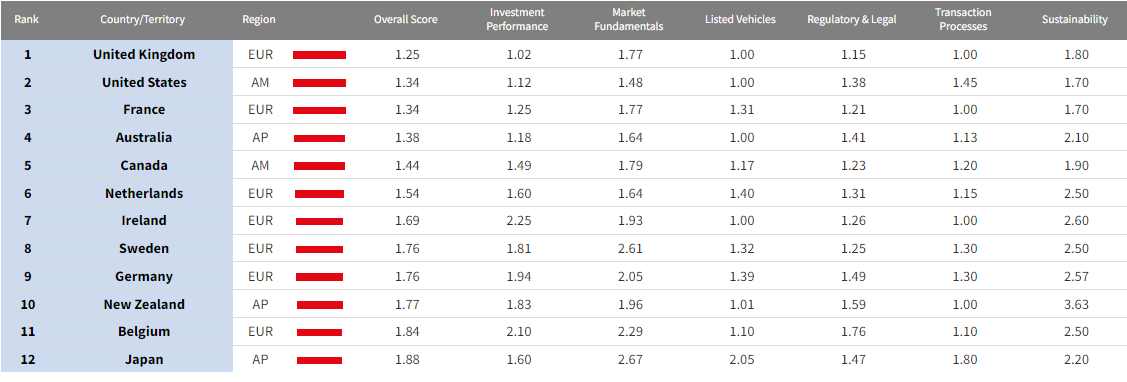

Updated every two years, this 12th edition of GRETI is based on a comprehensive survey of the availability and quality of performance benchmarks and market data, governance structures, regulatory and legal environments, transaction processes and sustainability instruments in 156 cities across 94 countries and territories. GRETI is an essential guide for cross-border investors, developers and occupiers of real estate – as well as government and industry bodies looking for international benchmarks.

Πηγή: JLL

Where Greece ranks

Greece ranks 37th among the countries with a moderate degree of transparency (semi-transparent) and a general score of 2.73.

Regarding the individual indicators, our country's performance, according to JLL data, is as follows:

Measurement of investment performance – 3.18

Market Basics – 3.24

Governance of listed vehicles – 2.41

Regulatory and Legal framework – 2.25

Transaction process – 2.13

Sustainability – 3.07

Although at the global level Greece's position places it several places above the average, our country's performance is among the lowest in the EU, with only Bulgaria, Croatia and Malta recording lower scores.

Find out more.