Caught up in a whirlwind of long-term upheavals in demographics, climate change, technology and lifestyles, real estate faces a major challenge to be fit for purpose.

It is a challenge that involves changing the uses to which real estate caters while building in greater flexibility so it can remain useful over time — not to mention a transformation of its environmental sustainability and social impact.

Set against this need for change, the pandemic and war in Europe have disrupted goods and energy supplies to create highly inflationary conditions, making real estate renewal much more expensive to achieve. Yet the industry leaders canvassed for Emerging Trends Europe are looking beyond the short-term disruption to markets and regard climate change as the most important challenge for real estate over the next 20 years.

The threat of obsolescence over the next five years concerns nearly half of survey respondents, even if other issues, notably construction costs, are front-of-mind in the shorter term. Moreover, environmental sustainability, one of the key factors driving obsolescence, is seen as a bigger immediate concern.

The implication is that while surging construction costs are seen as a temporary hurdle, it will be impossible for the industry to overlook accelerating change in the demands of occupiers, the increasing influence of regulators and the climate agenda

There is also a strong view that places need to be more flexible to cope with more rapidly changing occupational demands. This is reflected in the emphasis on repurposing to mixed-use in the survey responses but goes further than that. One residential operator notes that assets that target specific groups necessitate a high level of portfolio churn, whereas the objective should be to satisfy people where they are.

In other words, “we need to create places where your home and area can evolve along with you. Digitisation can contribute to that.” Local government also has a crucial role to play in creating places that are fit for purpose. Without a coherent vision it is difficult for the real estate industry to understand which projects will be permissible and how to meet the specific needs of the locality, whether developing from scratch or repurposing.

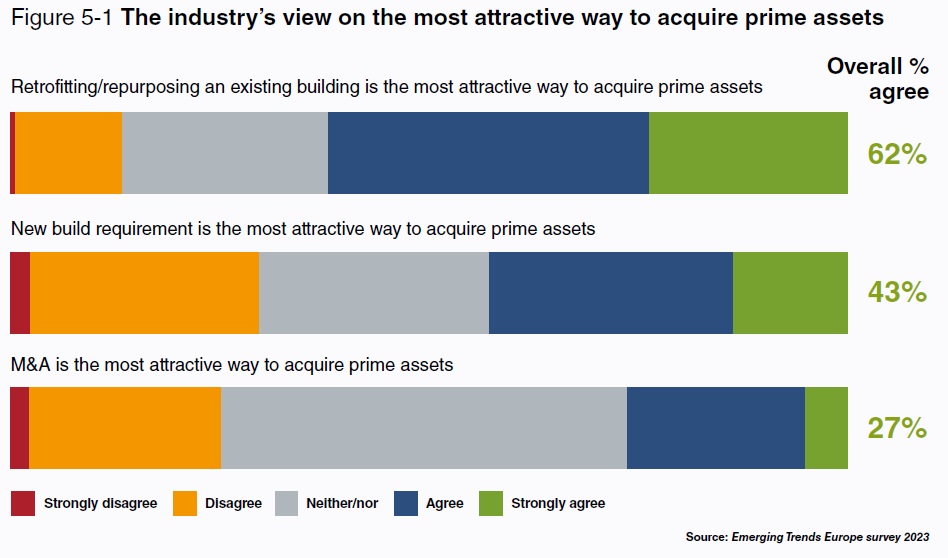

Refurbishing or redeveloping existing stock can either involve reconfiguration to meet the changing needs of similar kinds of user or a complete change of use – in other words repurposing. As the survey makes clear, the motive here is not just about dealing with the threat of obsolescence: nearly two-thirds of respondents believe repurposing or retrofitting an existing building is the most attractive way to acquire prime assets.

The survey shows that repurposing existing stock from one sector to another is on an upward trend, with 54 percent of respondents repurposing more assets in their portfolio compared to the previous year, a figure that is up from 52 percent in the last survey.

Likewise, more than three-quarters expect to be repurposing still more assets in five years’ time, again up from last year’s survey. Further impetus has come in cities such as London and Brussels where the planning authorities insist that developers fully explore the possibility of retrofitting before permitting completely new development.