Real estate continues to exceed the combined value of global equity and bond markets, and the comparison with gold is striking: the total value of all gold ever mined corresponds to just 5% of the value of global real estate.

In 2024, there was a slight annual decline of 0.5% in the global value of real estate—a development mainly attributed to a 2.7% drop in residential property values, largely due to China, which accounts for about 25% of global housing value. In contrast, housing prices rose in most countries, supported by strong demand and new supply.

By comparison, at the end of 2022 (according to October 2023 data), the total real estate value stood at $379.7 trillion, having then recorded an annual drop of 2.8%, mainly due to high interest rates and economic uncertainty.

The value of commercial real estate increased by 4.1% year-on-year, reaching $58.5 trillion, bolstered by new developments and price stabilization. Investments in production facilities—for example, in the U.S. through reshoring policies—further strengthened the sector.

Equally impressive was the rise in the value of agricultural land, which grew by 7.9%, reaching $47.9 trillion. This increase is driven by growing global demand for food, energy, and raw materials, combined with reduced supply due to urbanization and soil degradation.

North America Leads the Way

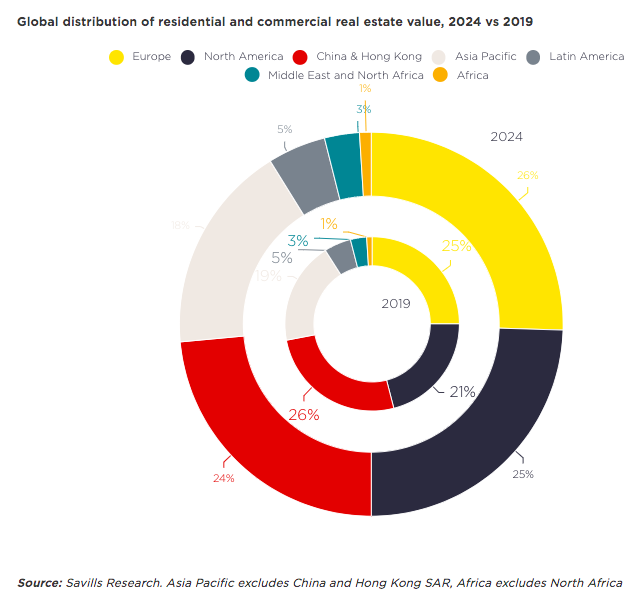

Among regions, North America recorded the highest increase (+44% since 2019), raising its share of global real estate value from 21% to 25%. This growth is attributed to the stable U.S. economy and new construction activity.

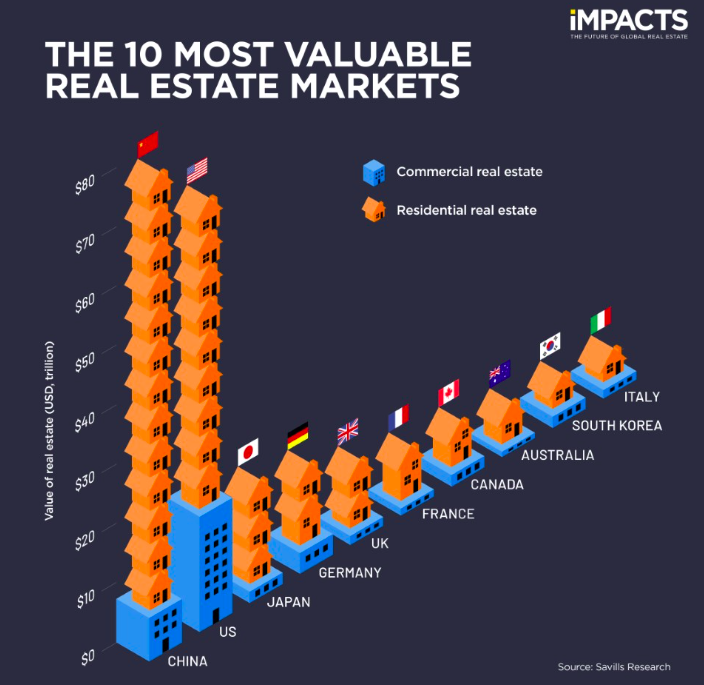

China retains its position as the world’s most expensive real estate market, with 23.5% of total value, followed by the U.S. at 20.7%. The top ten is rounded out by Japan, Germany, the United Kingdom, France, Canada, Australia, South Korea, and Italy—together accounting for 71% of global real estate value.

In comparison, in 2022 (according to 2023 data), China held 26% of global real estate value and the U.S. 19%, while the G7 countries along with China represented two-thirds of the global market.

Development under Pressure: Where Are the Opportunities?

The global real estate market is not only the largest "store of wealth," but also a reflection of macroeconomic and geopolitical developments. Despite the pressures, the real estate market remains three times more valuable than global equity markets. Structural needs for housing, development, and infrastructure will continue to support demand.

High interest rates and low affordability may slow the growth of residential real estate, especially in China, but a policy shift favoring increased housing supply in many countries presents a potential counterbalance.

The commercial sector appears poised to continue its upward trajectory, driven by investments in data centers, artificial intelligence, and new industrial facilities.

Farmland, as a limited natural resource with a critical role in climate resilience and food security, is expected to continue its upward trend.