For companies, supply chain delays and bottlenecks can have an existential impact on costs. Unsurprisingly, a growing number of businesses are proceeding with, or accelerating, reshoring plans to limit their exposure to these risks.

Solutions that can effectively safeguard inventories focus on diversification of inventory quantity and location. Rather than shutting down plants or ending contracts with suppliers in offshore locations, companies are adding additional plants and suppliers closer to or within Europe.

According to JLL's Uncoveringpotential in a reshoring EMEA report, just-in-time (JIT) inventory management is gradually being replaced by a just-in-case (JIC) approach which involves holding more inventory closer to customers or manufacturing facilities.

Together with a growing trend to reshore to the EMEA region, JIC inventory management means that warehouse requirements will increase closer to endcustomers as well as to new production and supplier locations. According to a recent survey conducted by BCI Global, as much as 60% of US and European companies are planning to bring some of their production from Asia back to their own region.

Based on current case studies of retailers and

manufacturers that have already decided to reshore

part or all of their production, the primary

beneficiaries of reshoring are Central Europe,

Romania, Turkey and Morocco.

Severe supply

constraints in prime markets along supply chain corridors

will push demand to strategically located secondary

and tertiary markets along these same corridors.

An elevated risk of disruption due to unexpected

events associated with climate change, shifting

trade agreements, and geopolitical unrest has

always been a challenge for global supply chains.

However, lockdowns during the pandemic put

unprecedented pressure on production and

distribution networks created by plant shutdowns

and bottlenecks at gateway ports that are still

driving up costs today.

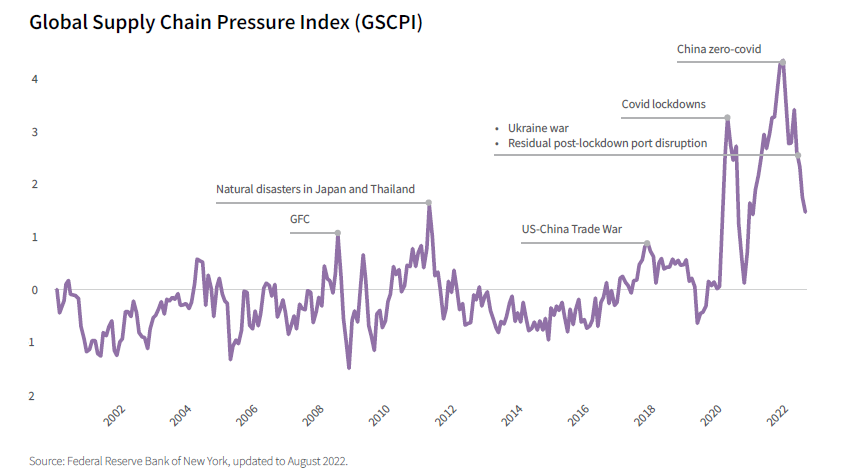

The Global Supply Chain Pressure Index (GSPI)1 , a measure of international supply chain disruption created by the Federal Reserve Bank of New York, shows that supply chain pressure soared during the first lockdown period of the Covid-19 pandemic. Although it briefly fell back as countries re-opened, it subsequently shot up again to a new high as reopening caused demand to accelerate but supply couldn’t keep up. Factories remained shuttered or only partly operational, workers were forced to isolate, and international ships and containers were in the wrong place, or unable to dock and load/ unload. China’s zero-covid has policy continued to cause city-wide lockdowns in 2022, even as the rest of the world vaccinated and moved on, keeping international supply chain dirsuption (and the index) high.

Only as new shipping capacity has come online

and operators have found work-arounds has supply

chain pressure eased. Yet it remains elevated and

volatile by historic standards.

Reliance on only a small number of major suppliers

based in Asia is a risk that can be addressed

through reshoring or nearshoring other suppliers

closer to plants and customers in Europe.

Without

disrupting production by moving plants closer to

home, in the short term businesses can mitigate

the risk of supply shortages through diversifying

the number of suppliers and geographic locations

to build greater agility and resilience into their

supply chains.

Total TEU volumes in Europe rose from just over 40

million in 2000 to over 100 million annually since

2018. During this 18-year period, significant global or

regional events such as the Global Financial Crisis

(GFC) and the Eurozone monetary crisis, resulted in

temporary throughput fluctuations.

Based on the Container Freight Rate Index, over a

two year period, starting in January 2020, container

costs from Asia to Europe increased almost four-fold.

While coming down slightly since January 2022

(20%), container costs remain at a record high level.

Find out more.