After hitting record lows at the end of 2020, mortgage rates have dramatically risen over the last couple years, now hovering around 6-7% compared to the sub-3% rates seen in 2020 and 2021.

For homeowners with low mortgage rates, these increases imply an additional financial cost to moving to a new home — even one at the same price point.

This increased cost of transaction can often keep them “locked-in” to their current home in what is known as a rate lock as homeowners wait for better rates (oftentimes, resulting in a hold up of housing supply).

Moving and selling would mean prepayment of the current mortgage and remortgaging a new home at significantly higher rates, resulting in stronger incentives to hold off on selling their home.

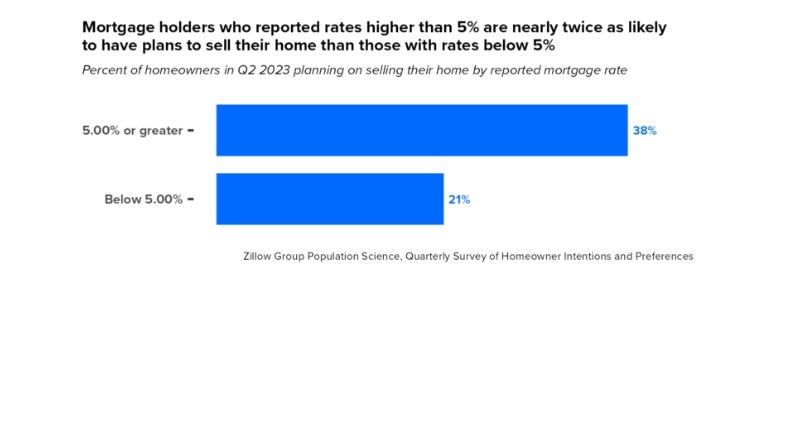

Mortgage holders who, as of June 2023, said they had rates higher than 5% are nearly twice as likely to have plans to sell their home in the next three years than those with lower rates.

These homeowners face no or relatively little financial disincentive to trading their current mortgage for a new one. In fact, of homeowners who reported plans to sell, 47% of homeowners paying a mortgage above 5% already have their house listed “for sale” compared to 20% of those with rates below.

On the flip side, homeowners already paying a lower interest rate may be reluctant to move and refinance at a higher rate.

The split between those reporting a 4.00-4.99% and 5.00-5.99% rate reveals the greatest divide in homeowner intent to move: 41% of homeowners at 5.00-5.99% consider selling, while only 26% of those at 4.00-4.99% say the same.

That said, while the most striking divergence for locked movers in June 2023 was at a 5.00% mortgage rate, it has varied between 4.00 to 5.00% in the past four quarters (i.e., 5.00% for September 2022, 4.00% for December 2022, and 4.00% for March 2023). This oscillation could indicate that the true inflection point – the rate at which homeowners are less likely to move – is generally between 4.00 and 5.00%.

Αround 90% of mortgage holders reported having a rate less than 6.00%, about 80% of mortgage holders reported having a rate less than 5.00%, and almost a third reported a rate less than 3.00%.

What does this mean?

As mortgage rates hover just shy of 7.00% in the past month, most of today’s mortgage holders would be forced to finance any new home at a higher rate than their current one, an incentive to hold on to their home rather than move soon.

A recent study by two finance professors, Julia Fonseca and Lu Liu, found that mortgage lock can happen even without increasing market rates.

In general, moving is costly. Even if the market rate is equal to or even slightly below the mortgage rate at purchase, homeowners have to weigh whether the benefit of financing a new home at a similar or lower rate is worth the other costs of moving.