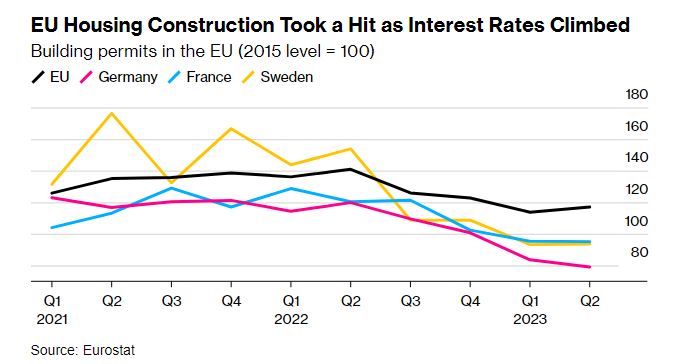

According to Bloomberg, residential building has tumbled as costs soar, while sluggish bureaucracies and increasingly stringent energy-efficiency regulations add to the headwinds. With housing supply being already tight, the situation threatens to weigh on growth and further stoke political tensions, as shortages put more and more pressure on voters.

The hardest-hit countries are among the wealthiest. New building permits in Germany have fallen more than 27% in the first half of the year. Permits in France are down 28% through July, and UK home building is expected to drop more than 25% this year. Sweden is suffering its worst slump since a crisis in the 1990s, with building rates at less than a third of what’s deemed necessary to keep up with demand.

The downturn is affecting single-family homes, as well as large housing projects.

Vonovia SE, Germany’s biggest landlord, this year shelved all new construction indefinitely. And in Sweden, a key project to make battery cells for cars and reduce the region’s dependence on supply from China, risks struggling to attract enough workers because of a lack of housing.

The situation means governments are falling short on promises to voters. Sweden has a constitutional pledge to provide affordable housing, but supply of rental apartments hasn’t kept up with demand for decades, driving up home prices and forcing people to live in black-market sublets. In the UK, home building has consistently missed a target of 300,000 houses per year set by the ruling Conservative government in 2019.

In Germany, affordable housing was one of the key commitments made by Chancellor Olaf Scholz’s ruling coalition when it took power in 2021, but economists estimate that the government won’t reach its goal of adding 400,000 new homes annually until 2026 at the earliest.

The squeeze on housing risks widening social divides by forcing people to shell out more of their income for accommodation. Attitudes toward migrants could also further deteriorate as they’re increasingly seen as rivals for scarce living space.

Trends aren’t dire everywhere. In Portugal and Spain, housing starts are well above levels in 2015, when the aftermath of the debt crisis all but froze building in those markets. But there are still severe shortages, showing how difficult the problem is to fix, and initiatives to lure investors — like Portugal’s golden visa program — have caused home prices to surge.

The construction crash has led to calls for incentives and industry support, but governments have limited appetite for additional spending after the Covid pandemic and amid efforts to rein in inflation. The result is a wave of company failures and restructuring cuts that risk reducing long-term building capacity.

In the UK, about 45,000 residential property builders have shuttered over the past five years. In Sweden, 1,145 companies in the construction industry filed for bankruptcy in the first 10 months of this year, an increase of 35% from 2022, according to data from Creditsafe.

Politicians are gingerly weighing in. Britain’s Labour Party has pledged a package of reforms to accelerate the country’s sluggish planning system and to build 1.5 million homes over the next term of Parliament.

Portugal’s government aims to increase the amount of real estate available for residential use and simplify licensing procedures. Germany pledged to simplify building rules and boost public investment, but the tepid action isn’t expected to offer much relief.

What's the situation in the Greek real estate market

Meanwhile, the real estate market in Greece is being portrayed as one with soaring rents and serious shortages in family homes. Investment stimulus policies like the "golden visa" and tax breaks offered to foreigners have acted like a bait for illegal money, altering the local real estate market.

The significant increase in the cost of living and low wages have been a deterrent in the housing market and have led to rent increases. Rising rents are an attractive condition for large capital investments in the housing market, resulting in a continuing upward spiral in rents.

At the same time, the "Golden Visa" program, which was established in Greece in 2013, in addition to the sharing economy, contributed to increased inflows of foreign capital towards the Greek real estate.

The strong dynamics of the real estate market are reflected in a strong rise in residential investment in the first half of the year, by 46.8% year-on-year, compared to a milder increase of 16.4% in the first half of 2022. In addition, the first five months of the year, building permits increased by 11.5% (vs. 1%, during the first five months of 2022), while the construction output index increased by 16.8%, during the first half of 2023 (H1 2022: 20, 8%).