In their majority those funds -c. 77 million euros- were floaded into office buildings, as the portfolio of L.P. basically ended up in L.P. Ellinas, which was auctioned from its creditors with an office buildings in Maroussi. TRADE ESTATES has also put the shopping centers in frame, investing more than €50 million in Athens and Thessaloniki. Residentials seem to emerge as the new "must" in a REIC's portfolio and Prodea has -in collaboration with LiveWise- made it first steps in the sector, while the HEMLET student residences have been added to the PREMIA portfolio.

A significant interest in particular for the Athenian office market has been reflected in an average annual growth rate of 4.5% for 2021, while high-end shops recorded an average annual growth of 2.1%.

According to ELSTAT data on construction activity, on an annual basis, particularly high growth rates are recorded in the number of new permits for the construction of offices (29.7%) and shops (67.9%) and hotels (51.2%). while correspondingly very high rates, both in terms of the number of new licenses and in terms of volume, are recorded in almost all real estate for professional uses, a fact indicative of the strengthened demand and the tendency to renew the existing stock.

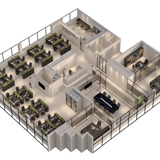

In further detail, the investments of the domestic REICs in the first half of 2022 are as follows

Prodea Investments

The REIC has completed the acquisition of five adjacent plots of 10.4 thousand sq.m. in Maroussi, Attica for €13,767,000. The purpose of the acquisition is the development, after the demolition of the existing building, and the exploitation of a modern office complex with at least LEED Gold environmental certification, which will consist of two autonomous and functionally independent buildings with a total area of more than 17 thousand square meters. m. At the same time, acquired 80% of the share capital of THRIASEUS SA. against €528,000. THRIASEUS S.A. on May 31, 2022, it acquired 17 plots of land in Aspropyrgos, Attica, with a total area of 111,000 square meters. on which he plans to build a modern Storage and Distribution Center with a total area of 39.8 thousand sq.m. On June 6, 2022, acquired a fully leased office building in Marousi, Attica, on Heimarras 8B and Gravia streets, with a total area of 14.1 thousand square meters, for €35,000,000 and on June 22, 2022, it proceeded to acquire 100% of of the share capital and corporate shares of five companies in Greece, which own nine residential plots and an existing residential building, which is fully leased, for the purpose of developing residential properties for sale and rent. The price for the acquisition of the companies amounted to €16,291,000. Finally, on June 26, 2022, the company Fondo Five Lakes – Real Estate reserved closed-end Fund (Italian Real Estate Reserved AIF) was established in Italy, which owns 75% of the shares of Five Lakes and is a participation in a consortium

Premia Properties

Premia Properties completed in the first half of the year the acquisition of a leased five-storey property, 19 apartments, that operates as a student dormitory, with a total area of 526.74 sq.m., on a property located at 4 Kastelorizou Street in Kypseli, Attica. The price for the acquisition amounted to € 0.72 million (not including acquisition costs of € 0.05 million). At the same time, it proceeded to acquire 100% of the shares of Valor I.K.E. (hereinafter "Valor") which was considered as an acquisition of a group of assets and liabilities and not a business combination, which owns, through a financial lease, a leased property of eight floors, 85 apartments which functions as a student residence, with a total area of 4,666.2 m2 .m., on a property located at 10 Valaoritou & Orfanidou Street in Thessaloniki. The price for the acquisition amounted to € 2.98 million. On May 25, 2022, the subsidiary company PREMIA MAROUSI proceeded to acquire a leased property, school buildings, sports and cultural facilities of Doukas Schools, with a total area of 23,113.91 sq.m. on a property located at 515 Mesogeion Street & Kyprian Agoniston in Marousi, Attica. The price for the acquisition amounted to € 19.63 million (not including acquisition costs of € 0.17 million).

Trade Estates

On 18/2/2022, the Company acquired 100% share capital of the company "KTIMATOMOMI TECHNICAL TOURISM MARITIME AGRICULTURAL AND COMMERCIAL SOLE REPRESENTATIVE ANONYMOUS COMPANY" which owned the FLORIDA 2 shopping center for an amount of €37,216 thousand with a total area of 31,302 sq.m. in Pylaia, Thessaloniki. In addition, the REIC announced the signing of the agreement to purchase shares of BERSENCO DEVELOPMENT AND EXPLOITATION OF REAL ESTATE LLP, owner of the new green Commercial Park on Piraeus Street for €18.1 million. The Commercial Park is located at 54 Piraeus Street, in Neo Faliro. an area of 14,895 sq.m., with commercial areas of 14,555.46 sq.m. 400 underground parking spaces.

Trastor

At the beginning of the year, Trastor REIC was declared successive bidder for the acquisition of a plot of land with an area of 1,023.14 sq.m. on which an office building has been erected, with a total area of 2,165.86 sq.m., which is located in Paradisos Amarousiou, Attica, on Amarousiou - Chalandriou street. The total acquisition amount of the plot amounted to € 2,351,000. In the first half of the year, it signed a construction contract with its 100% subsidiary company DORIDA SA. for the addition of a new Storage and Distribution Center for dry and refrigerated facilities with a total area of 6,800 sq.m. approximately, on its own land with already existing Storage and Distribution Centers in Aspropyrgos, Attica. At the beginning of June, it acquired an independent office building of 16,795 sq.m., which is located in Marousi Attica at the junction of Sorou 18-20 and Amarousiou Chalandriou streets for €27,050,000. During the summer, it acquired two independent commercial warehouses, with a total area of 17,708 sq.m., which are located in the Municipality of Aspropyrgos, Attica. for € 12,950,000 and sold an independent office building located on Ag. Andreou 3, in Ag. Friday, for a total price of € 2,700,000.

ORILINA

ORILINA PROPERTIES REIC acquired along with LAMDA DEVELOPMENT S.A. of the special purpose vehicle (SPV) LIMAR S.A. that owns plots of land with a total area of 72,121 sq.m. next to the Mediterranean Cosmos shopping center, in eastern Thessaloniki. It is been noted that ORILINA PROPERTIES owns 80% and LAMDA the remaining 20%.

The company also carried out its first placement in HELLENIC, announcing the signing of an MOU with LAMDA DEVELOPMENT for the creation of a Prive club with luxury restaurants and "branded" residences-apartments with a sea view, whose owners will automatically acquire membership to the club on plots of land in the area of Agios Kosmas Marina. Finally, the company proceeded to purchase approximately 2,000 sq.m. which extends over 3 floors on the National Resistance of "Archontikos Kalamaris" which belonged to the Haragionis group. The total amount of the investment is expected to exceed €4.5 million.