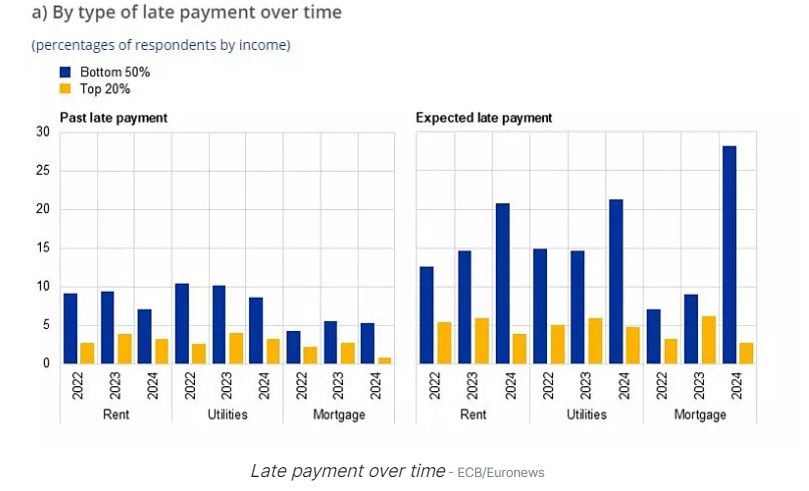

"The ability of households to cover housing costs and mortgage payments is a source of concern, especially for lower-income households," ECB analysts Omiros Kouvavas and Desislava Rusinova wrote in an economic note.

According to the Bank, the amount of resources dedicated to managing concentrated credit exposures

increased over the review period, especially as regards exposures to banks and

dealers. The use of financial leverage declined somewhat over the review period.

Respondents reported increases in the intensity of efforts to negotiate more

favourable terms for all counterparty types. They also reported declines in the

volume, duration and persistence of valuation disputes at the level of individual

counterparty types.

Since the Central Bank began raising interest rates in July 2022, overall housing costs have risen by 6% for owner-occupiers, but by 12% and 9% for mortgage lenders and renters respectively, the report found.

The corresponding data unveil that in January 2024, households paid an average of €765 per month in total housing-related costs, including utilities (such as gas, electricity and water), home maintenance and rental costs or mortgage.

Housing costs take up about 40% of income for renters, 35% for those with mortgages and 20% for homeowners. Meanwhile, those on the lowest incomes who have to rent their homes face paying around half their monthly salary in costs.

Heavier burden for mortgage borrowers

Of the three main categories, those with a mortgage face the highest costs, due to increased interest rates, with their average monthly payment exceeding €1,100. Interest rate increases have also left their mark on the rental market. Rising borrowing costs have stalled new investment, while the rental market, already facing a shortage of available homes, has seen prices rise accordingly.

Renters pay more than €800 on average in the 11 countries examined, according to the ECB, while owners are moving towards costs of €500 a month, mainly due to rising home maintenance costs. Utility costs have recently been reduced.

Of the 11 countries, housing costs appeared to be the highest in Ireland, at around €900 a month excluding mortgages, but more than around €1,200 if the mortgage payment is included. Housing bills are the second and third highest in Germany and Austria, at around €750 (€900 with mortgages). Citizens in Greece and Portugal have the lowest housing costs of the 11 countries.

When housing costs were considered as a proportion of a household's income, Austria appeared to be the most expensive country, with 29% (33% if mortgages were included in the calculations) of income covered by such costs.