Highs include the real estate bubbles that occurred in several countries during the 2000s, and lows include the decline that followed the financial crisis of 2007–2008. The average price of a house increased by almost 50% between 2001 and 2006. Contributing dramatically to this were also the inadequate risk management procedures in credit issuance and the resulting origination of subprime mortgages and mortgage-backed securities.

The collapse of the housing bubble came in 2006 in the United States, two years after the FED had started to tighten monetary policy while other countries were impacted later in 2008. House prices were declining, and interest rates had risen to levels that made homeowners unable to refinance their mortgage payments.

In 2007, the housing market plummeted, reaching a 20% drop between 2007 and 2011, forcing a massive sell-off in mortgage-backed securities, while numerous delinquencies, defaults, and foreclosures that followed led to the Great recession.

Prior to the COVID-19 pandemic, which increased the rate of increase in 2020 and 2021 by an average of 10% across the EU and the United States and 9% for the top 20 OECD countries, house prices had increased by an average of 6-7% per year since returning to pre-crisis levels in 2016. Lastly, the curve in 2022 became steeper due to the recent inflation hikes.

However, the situation in Greece has been slightly different. The country experienced a more than 50% increase in real house prices and almost 90% in nominal prices between 2000 to 2007. Following that, both the international and domestic financial crises negatively affected the country and house prices declined sharply for more than a decade, such that by 2018 they were below those of 2000. Only since 2019 have real house prices in Greece normalized, following global trends and gradually picking up.

Construction costs

Construction

boom and increased demand in Greece which resulted in significantly higher costs

than the average of EU-27 until 2015, despite the domestic financial crisis

of the time. From 2016 to 2020 the changes were not noteworthy. In 2021

and 2022 construction costs rose at a rate of 2.8% and 6.8% respectively

proving that Greece was among the countries in Europe that were

affected at a lower scale compared to the EU-27 average.

Real estate activity

in 2022 continued

the previous year’s

strong momentum.

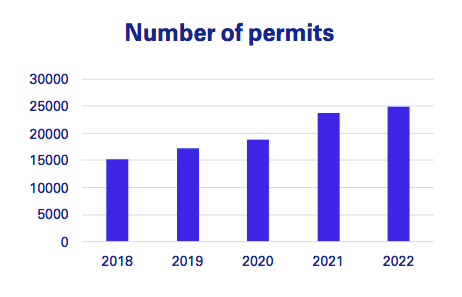

The number of total issued building

permits amounted to 29,213 an

increase of 4.6% versus 2021.

Building surface / volume reached

5.4m sqm and 24.5m cu m, which

corresponds to a decline versus

2021 of 8% and 2% respectively.

In respect to the Material Cost

index, prices continued the high

pace of increased initiated from

2020 and onwards. The increase

for year 2022 versus 2021 was 11%.

Among all materials, the energy

related materials rose by 34% and

the cumulative increase from 2020

amounts to 50%.

Main trends and challenges

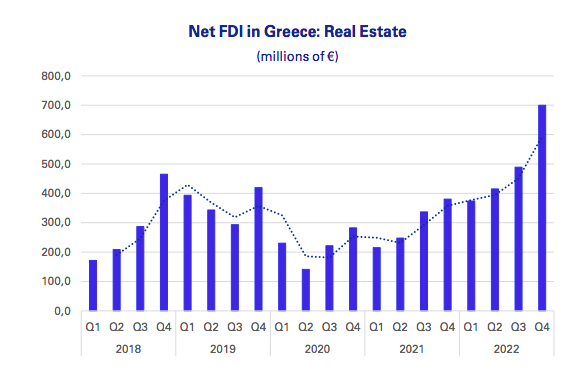

Fueled by the economic recovery, loose monetary conditions and a perceived dislocation in pricing, from 2018 onwards the Greek real estate market witnessed a large increase in activity from foreign as well as domestic real estate players, often in partnership. This has resulted in a large consolidation of the fragmented real estate market and a massive transfer of asset ownership from over-leveraged, unsophisticated and non-institutional investors (including private individuals, family businesses, the Greek State, Greek banks and NPL portfolios) to sophisticated, well-funded and professionally managed investors.

There is also still a large potential supply of assets for investment and development as Greek banks and NPL funds/servicers look to sell on a relatively large stock of REOs in the coming years, as well as public entities such as the Hellenic Public Properties Co. (HPPC) look to maximize the value of real estate owned by the Greek State.

As in many other sectors, an important transformation will take place in the real estate area. New technologies such as IoT, Big Data, GIS,ARVR, AI and Machine Learning help ensure that the end users will have more insights and influence when acquiring, developing and maintaining a property.

These developments can also make cities and buildings much more future-proof. This will not only affect the profit and quality in this sector, but above all will have an impact on the quality of living in the buildings and cities. Furthermore, these technologies go hand in hand with the future sustainability objectives that we must achieve together. Without a good digital basis, we can never monitor evaluate, and steer towards the goals that we must realize the upcoming years in order to make sure that future generations have the ability to meet their own needs.

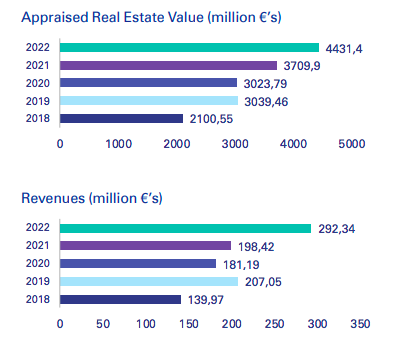

Greek REICs have grown significantly over the last 5 years

The total assets held by Greek REICs have grown significantly over the last 5 years, with the appraised value of real estate assets and revenues more than doubling over this period. This is as a result of new investments, upward appraisal of existing assets and, to a lesser extent, the formation of two new REICs during this period.

Between 2018 and 2022, the FFO displayed notable changes from 76.46 million euros in 2018 to 108.1 million euros in 2022, marking a significant growth of 41.6%.

Starting at 471 properties in 2018, there was

a steady increase each year in Greek REOCs portfolios, reaching 655

properties in 2022, indicating a total growth of

38.4%. The most substantial increase occurred

between 2018 to 2019, with a notable rise from

471 properties to 564 properties, representing a

notable surge of 19.7%.