The result marked an improvement on the prior quarter with 57% of cities seeing prices rise over the quarter.

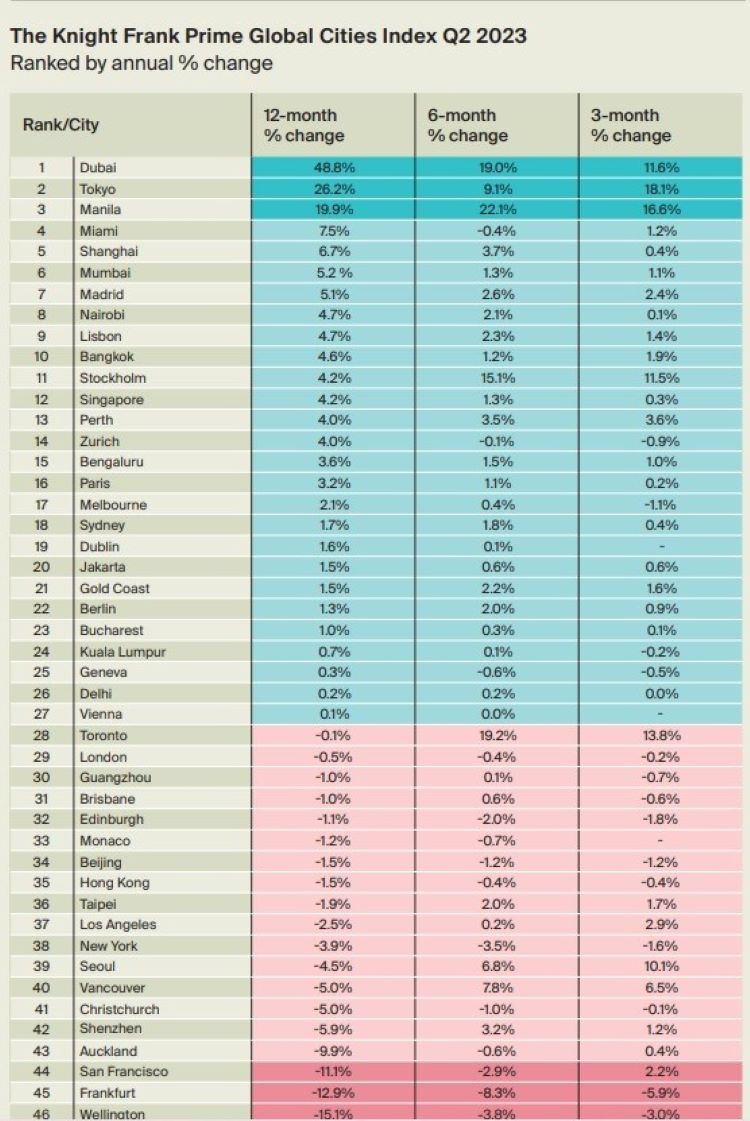

Price growth ticked up in the second quarter of 2023 across prime urban markets. The 1.5% average annual growth remains modest, and well down on the recent peak of 10.2% seen in the final quarter of 2021 but is the strongest rate of growth since the third quarter of 2022.

The shift to higher interest rates was the catalyst for the recent downturn in housing markets, and while policy rate tightening cycles are not yet at an end there is a sense in many markets that the worst of interest rate uncertainty is past and mortgage rates have begun to edge lower in several major economies.

Some of the markets worst hit by the housing slowdown, Auckland, and Stockholm for example, have turned a corner and saw positive growth over the past quarter.

Fully 57% of markets saw prices rise over the last three months, and 59% over the last 12 months.

City focus

Strong growth in Dubai continues. The Emirate maintained its top position in our ranking for the eighth consecutive quarter, rising by 48.8% in the 12 months to June of this year.

Remarkably, prices in Dubai have soared by 225% since reaching a pandemic low in Q3 2020.

London's prices continue to fall back, although demand has remained strong through the past 12-month period. The number of potential buyers in London July surpassed the fiveyear average by 24%.

This resilience isn't surprising, as around half of sales within Zone 1 typically involve cash transactions. Moreover, the market is being supported by the relatively weak pound benefiting foreign buyers, and the gradual return of overseas travel to pre-Covid levels.

(source: Knight Frank)